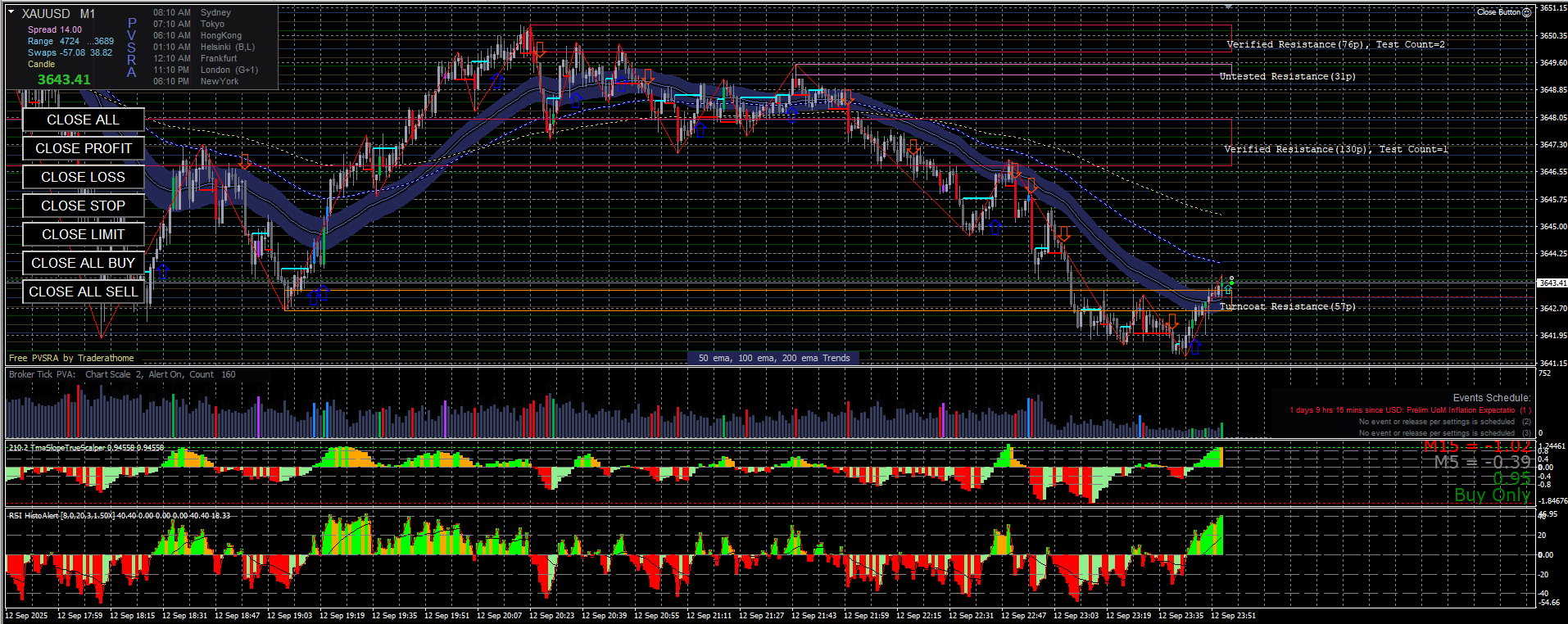

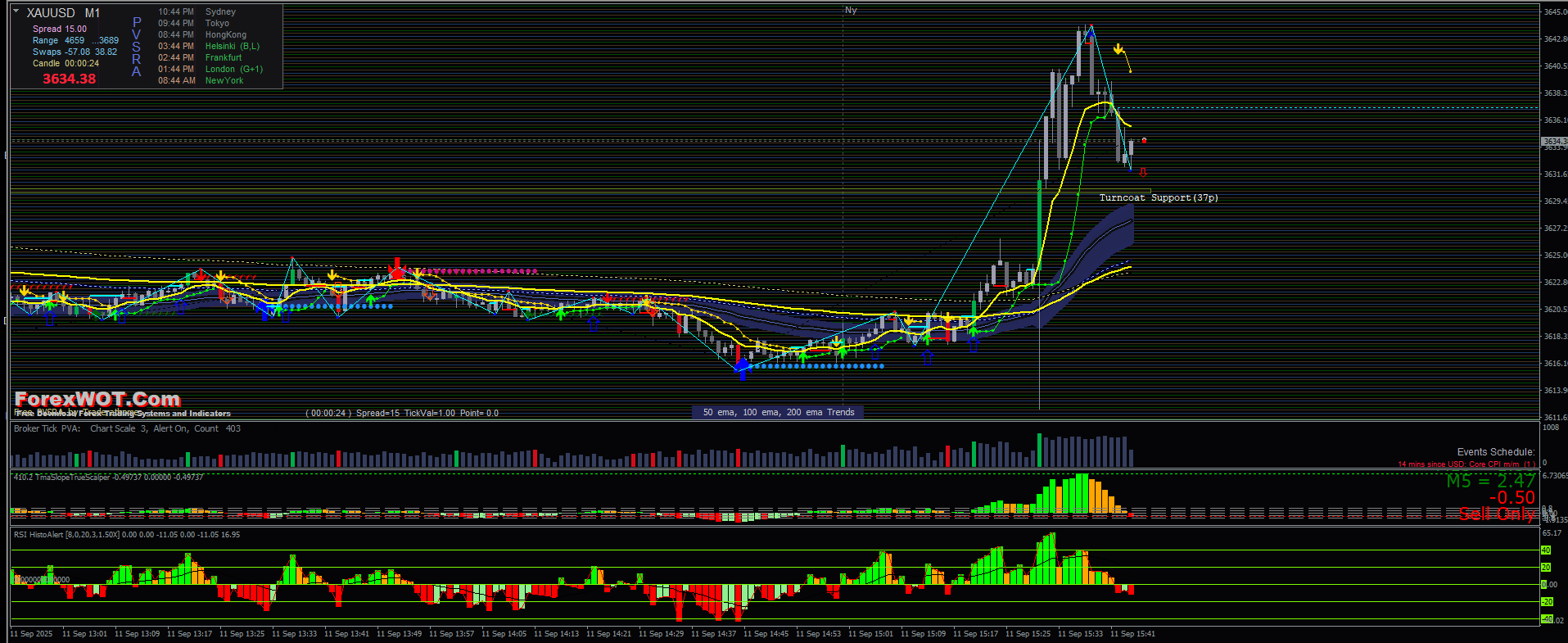

Gold Price Analysis: XAUUSD Strong Uptrend with Layered Demand Zones

Summary:Gold continues to rally in a strong bullish trend, forming higher highs and higher lows. Demand zones between 4180–4220 remain key supports for buyers, suggesting the uptrend is intact as long as price stays above these levels. Gold Price Technical Outlook (XAUUSD, 30-Minute Chart) The 30-minute XAUUSD chart shows a well-defined bullish structure. Price has … Read more