The Power of Confluence in Forex

Since 2000, I have been working as a webmaster and designer, and since 2018 I have also been pursuing my path as a professional trader. My 30-year background as an agricultural engineer gave me a mindset of discipline, observation, and systematic evaluation of data. This engineering perspective became my compass in the markets as well: not trading randomly, but with structure; not relying on emotions, but on evidence.

Over the years, I have refined my focus on market structure and the logic of confluence. I often use tools such as multi-timeframe (MTF) analysis, 3 Candle Reversal (3CR), 2B reversal, EMA 9/50/120, RSI HistoAlert, and TMA Slope. But my trading approach is not limited to these indicators alone. The real priority is to see everything that is clearly present on the chart without skipping details, and to use MTF analysis to understand which larger structure the price currently belongs to.

This is like determining a coordinate: first looking at the monthly, then the weekly, followed by the daily, and drilling down through H4, H1, M30, M15, M5, and M1 candles to identify the exact position and direction of the market. I often compare forex to a bus stop: our job is to prepare the stop and wait patiently for the price to come and pick us up. Jumping too early or waiting at the wrong stop only brings losses.

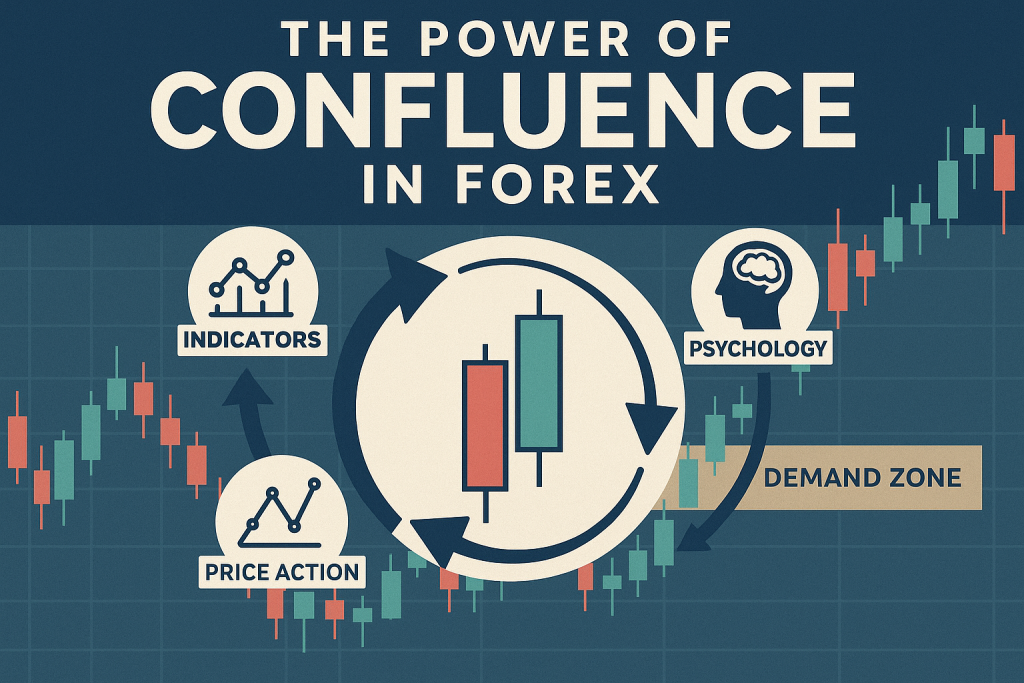

What Is Confluence?

Confluence simply means the alignment of multiple technical factors, price action signals, and psychological elements at the same level. A single RSI divergence, a single EMA break, or a single candlestick pattern might not be reliable by itself. But when several signals point to the same zone, that area becomes a high-probability trade location.

Many traders make the mistake of worshiping one indicator or one pattern. The market, however, is multi-dimensional: trend, momentum, volume, and psychology must all be read together. Confluence brings this multi-dimensionality into a single decision framework.

Why Does It Matter?

- Reduces risk: Instead of opening a trade based on one weak signal, you wait for several confirmations. False signals decrease significantly.

- Improves psychology: Trading becomes more disciplined and less impulsive. You learn to wait for your setup instead of chasing random moves.

- Builds consistency: Applying the same rules repeatedly gives both statistical reliability and long-term profitability potential.

Examples of Confluence

- 3 Candle Reversal + EMA 50 (Dragon): When a 3CR forms at the same area where the EMA 50 confirms support or resistance, it often marks a strong reversal point.

- RSI Divergence + TMA Slope: A divergence in RSI is weak alone, but when confirmed by the slope of TMA, the trade becomes more reliable.

- PVSRA Volume + Price Action: A high-volume engulfing candle formed near a previously marked supply or demand zone highlights a critical liquidity point.

Knowledge Sharing and Philosophy of This Site

The purpose of this site is not only to keep my own notes but also to share with others. If you spend time here regularly, I believe the new articles, explanations, comments, and updates will contribute to your growth. Everything here will always be free. There will never be hidden payments or premium tricks.

All the indicators I use are free, and I openly share them with you. I explain everything I know without hesitation. In trading, there is no new invention—everything is already known. The key is how to combine it all together. That is exactly what confluence means: merging different parts into one strong framework. My goal is to show you how this combination works in the most practical way possible.

Discipline and Strategy

With my engineering mindset, I divide every strategy into three modules:

- Trigger: A price action formation.

- Filter: Indicators like EMA, RSI, or TMA.

- Confirmation: Volume, candle closes, and MTF alignment.

When these three come together—when confluence is achieved—the setup is worth trading. If one of them is missing, the trade is skipped. “No trade is better than a bad trade” is the principle that keeps me disciplined.

Conclusion

Long-term success in forex is never about a single indicator or a lucky guess. Confluence—the intersection of multiple signals at the same level—is the strongest compass a trader can have.

My background as an engineer, my years as a trader, and my experience as a webmaster and designer all shaped this approach. They taught me to observe, to structure, and to combine.

At the heart of my strategies and writings lies one core truth:

The more signals that align at the same point, the stronger the decision becomes.